Fastly’s 2025 AI Pulse Check set out to understand how sustainability experts and infrastructure leaders are tracking and optimizing AI energy use. The survey captured responses from nearly 500 professionals across North America, Europe, and Asia Pacific (APAC), most of whom hold engineering or sustainability roles at AI-focused companies.

Key Takeaways:

Only 1 in 10 companies in the USA and Europe track 75–100% of their AI workloads for energy use

Over two-thirds of all respondents say they track AI training and inference energy separately

Most companies estimate that 10–30% of their AI queries are redundant and believe optimizing them could cut energy use by a similar amount

Query optimization is happening, but mostly for select workloads. Only 1 in 3 US respondents say they use it extensively

Guaranteed performance improvements are the top motivator for more energy-efficient AI workloads, ahead of cost savings or regulatory pressure

Edge AI remains limited, with just 10% of companies primarily deploying AI at the edge. Cost, complexity, and performance are the biggest barriers

Tracking AI Energy Use

The first step toward managing AI’s energy footprint is understanding it. But our survey findings suggest many companies are still early in their tracking journey.

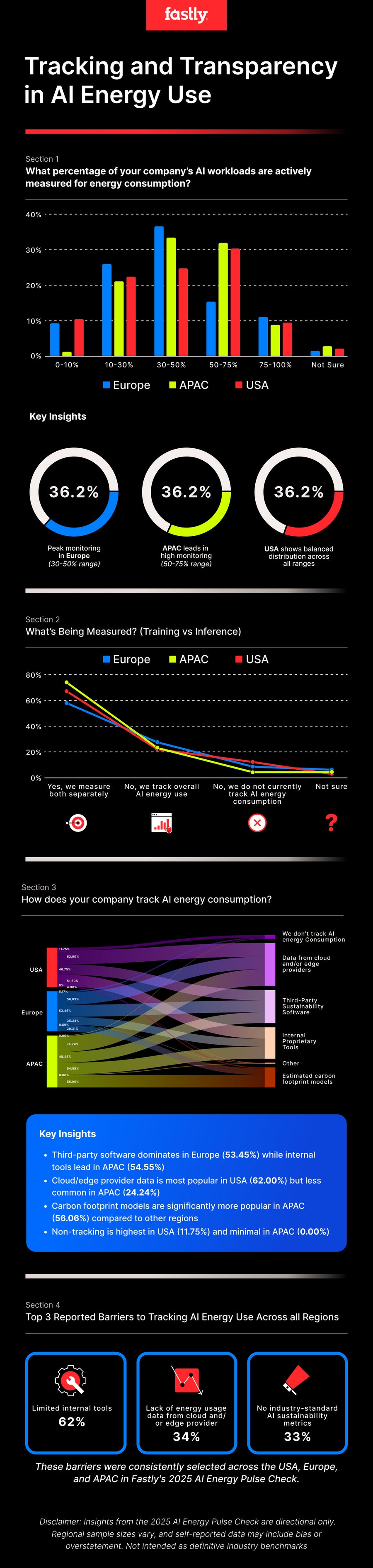

Just 9.5% of US and APAC companies and 11% of European companies track 75–100% of AI workloads.

The most common range to for tracking across regions is 30–50%

Around 2–3% in each region said they weren’t sure how much of their AI energy use is measured

Tracking Tools & Practices

How are companies actually tracking energy use? Most rely on a mix of internal and third-party solutions.

Cloud/edge provider data is the most commonly used tracking method:

74% in APAC, 62% in the USA, 56% in Europe

Internal tools are more common in APAC (55%) and the USA (52%) than in Europe (35%). Though please note that we had varying level of responses across regions, and the results are not completely comparable.

Barriers to Energy Tracking

Even when companies want to track energy use, roadblocks remain. The most frequently cited barriers:

Limited internal tools (up to 79% in APAC, 56% in the US, and 51% in Europe)

Lack of standardized metrics (around one-third of all regions)

Insufficient energy data from cloud/edge providers (Europe: 32.8%, APAC: 34.9%, USA: 33.5%)

Redundant AI Queries and Efficiency Potential

Redundant AI queries not only waste compute resources — they burn unnecessary energy. So how much of that inefficiency do companies believe they have?

Around 50% of respondents said 10–30% of their AI queries are redundant

APAC respondents were more likely to report higher redundancy, with 36% estimating over 30%. That said, take these regional comparisons with a grain of salt, as the sample size in APAC was smaller.

Most believe 10–30% energy savings could be achieved by optimizing queries. ~30% in each region estimate potential reductions of 30–50%. Fewer than 10% believe the savings could exceed 50%.

Adoption of Optimization Techniques

Are companies putting those efficiency beliefs into action? In many cases, yes — but usually not across the board.

Most companies use optimization (e.g., query caching, workload tuning) selectively:

59% in APAC, 57% in Europe, 42% in the USA

Around 10–20% are not yet optimizing but are considering it

What Would Accelerate AI Caching and Workload Optimization?

We also asked what would motivate companies to do more, and the answers were clear: it’s all about performance and cost.

Top factors that would make caching and workload optimization more appealing:

Guaranteed performance improvements (64–71%, depending on region)

Lower costs (47–59%, depending on region)

Regulatory requirements (41–61%, depending on region)

Customer demand and better integration tools were cited as secondary factors

Cloud vs Edge AI Deployment

While edge AI is often promoted as a greener, lower-latency option, few companies are all-in on edge. Hybrid is still the norm.

Most companies use a hybrid model (56% overall)

Cloud-only deployment is highest in the USA (36%)

Edge-only deployment remains niche, ranging from 9–12%

Complexity and hardware performance were the biggest blockers for edge AI deployment.

Top reported challenges:

Complexity in managing deployments

Edge hardware limitations vs. cloud GPUs/TPUs

Cost efficiency of cloud makes it more appealing for most

Energy-Based AI Pricing

We explored whether companies would support pricing models based on energy use instead of compute time. The answer? Largely yes.

Support for energy-based pricing:

85% in APAC, 75% in the USA, 67% in Europe

Fewer than 6% in any region strongly opposed the idea

Deployment Decisions and Energy

Is energy use influencing where companies run their AI? For some, it’s a primary factor — but most still prioritize performance or cost.

Energy is a key consideration for:

45% of APAC companies

36% in the USA

28% in Europe

Most said energy is considered, but not decisive

A minority in each region said energy isn’t currently part of their deployment strategy

Methodology

This survey was conducted online by Pollfish on behalf of Fastly between April 8 and May 1, 2025. It gathered responses from 497 professionals responsible for AI infrastructure and sustainability across the US (315), Europe (116), and APAC (66). Participants included IT leaders, infrastructure specialists, engineers, and AI operations leads.

To ensure quality, Fastly used open-ended validation to remove low-quality responses and confirmed demographic relevance, with most respondents falling into the expected mid- to senior-level age and experience brackets. While regional nuances existed, overall patterns were consistent across markets.

The insights shared from the 2025 AI Energy Pulse Check survey are intended to spark discussion, not serve as definitive industry benchmarks. The regional sample sizes vary significantly. As with any self-reported data, responses may include some degree of bias or overstatement. Readers should consider these findings as directional rather than absolute.

Want practical strategies for greener AI? Read our latest interview with Fastly’s Co-founder as he shares insights on building more sustainable AI infrastructure.