El Black Friday, tal como lo conocíamos, ha muerto.

O, al menos, la idea de un único día frenético de picos de compras online ha desaparecido sin hacer ruido. Durante años, el Black Friday fue el momento que esperaba Internet: el día en que las marcas ponían a prueba su infraestructura, el día en que los compradores ponían el despertador y el día en que las gráficas de tráfico de repente se convertían en montañas.

Según los patrones de tráfico de la base de clientes de comercio electrónico de Fastly, que incluye algunos de los retailers más grandes del mundo, el Black Friday como acontecimiento único y excepcional ya no es la característica definitoria del comercio electrónico durante las fiestas. En su lugar, observamos un patrón más sutil y distribuido que se extiende mucho más allá de un solo día.

Así fue el fin de semana conocido como Cyber 5 en 2025. Veamos en qué se diferencia de años anteriores y qué deben tener en cuenta los equipos de ingeniería al planificar futuras temporadas altas.

¿Qué es Cyber 5?

Antes de entrar en materia, hagamos un breve repaso sobre el Cyber 5. Se refiere al periodo de cinco días que va desde el Día de Acción de Gracias hasta el Cyber Monday, una ventana de ingresos crucial para los retailers y considerada durante mucho tiempo como la prueba de fuego para la infraestructura del comercio electrónico.

Sin embargo, en 2025 continuó una tendencia que hemos visto crecer durante años: el Cyber 5 ya no es un caso aislado, sino que se integra en una temporada de tráfico mucho más larga y sostenida que abarca todo el mes de noviembre.

Lo que Fastly observó durante el Cyber 5 de 2025

A pesar del aumento de la participación a nivel mundial en el Cyber 5, el poder adquisitivo sigue girando en torno al comportamiento de los consumidores estadounidenses y los calendarios de ventas. Durante todo el fin de semana, se produjo una caída constante entre las 09:00 y las 11:00 UTC. En Estados Unidos, este intervalo de tiempo refleja las tranquilas horas de la madrugada, antes de que comiencen las principales actividades promocionales. En Europa, los compradores ya han navegado (y probablemente comprado), mientras que en muchos mercados de la región Asia-Pacífico, el día está llegando a su fin a última hora de la tarde. Estos ciclos descendentes superpuestos crean un valle natural antes de que el tráfico vuelva a aumentar.

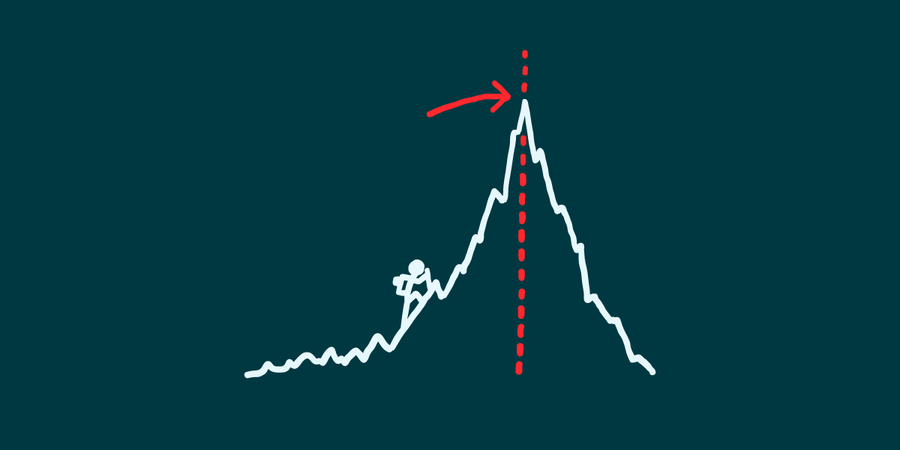

Aunque el pico del Black Friday puede que no sea tan alto como solía ser, sigue siendo el ganador del fin de semana Cyber 5. Como se puede ver en la imagen superior, el mayor pico en un solo día se produjo el Black Friday alrededor de las 15:00 UTC, lo que equivale a las 10:00 ET. Básicamente, los compradores se despertaron ese día y se pusieron manos a la obra para llenar sus carritos. Aunque puede que mantenga el título del momento de mayor tráfico, ya no destaca por encima del resto del mes: la ventaja es pequeña y cada vez menor.

Hablando de reducción, ¿recuerdas los días en que el Cyber Monday era el día para comprar todas tus necesidades electrónicas? Pero dado que la mayoría de las compras se realizan online y las rebajas que antes estaban designadas para el lunes duraban todo el fin de semana (si no todo el mes), la distinción del tráfico de los lunes se ha reducido. Nuestras observaciones muestran que el Cyber Monday se comporta de manera similar a los días circundantes, en lugar de destacarse como un gran crescendo.

Los bots van a llegar

Cada año, y con una urgencia creciente, surge una pregunta: ¿los bots impulsan cada vez más el tráfico navideño?

Según lo que observamos durante el fin de semana del Cyber 5, las proporciones del tráfico de bots no variaron de forma significativa. La ausencia de cambios en las proporciones de bots sugiere que, a pesar de la inquietud generalizada en el sector en torno a los agentes de compras automatizados y las compras impulsadas por IA, la composición básica del tráfico durante el Cyber 5 se mantiene en gran medida constante de un año para otro. En otras palabras, la presión que los retailers experimentan por parte de los bots durante los periodos normales no se ve amplificada de forma significativa por los incentivos navideños, al menos de momento.

Conclusión para los retailers: el patrón de tráfico máximo actual sigue siendo en gran medida humano, pero la base predecible de bots que vemos hoy en día puede que no se mantenga para siempre. A medida que la automatización se vuelva más sofisticada, su impacto en temporadas futuras podría ser mucho más acusado.

Un vistazo al futuro: prepárate para el comercio agéntico

Aunque los datos del Cyber 5 de este año muestran que los compradores humanos siguen generando la gran mayoría del tráfico, el sector retailer ya está mirando hacia algo más grande: el comercio agéntico.

En este modelo emergente, los agentes de IA actúan en nombre de los consumidores y las empresas: descubren productos, comparan opciones e incluso completan compras de forma autónoma. Aún es pronto, pero este cambio podría modificar radicalmente el comportamiento del tráfico durante las futuras temporadas altas. En lugar de picos de tráfico generados por los seres humanos, los retailers podrían observar cargas de trabajo e interacciones más continuas, al ritmo de las máquinas, que se producen mucho antes de que el comprador visite un sitio web.

Las marcas comerciales que se preparen para este futuro se basarán en los mismos fundamentos que importan hoy en día: una infraestructura rápida, sistemas resilientes, una seguridad sólida y una visibilidad en tiempo real. A medida que los agentes autónomos se integren en el ecosistema de compras, estas capacidades solo crecerán en importancia.

¿Sigue siendo especial el Black Friday?

Cuando ampliamos el enfoque y miramos más allá del fin de semana del Cyber 5, a todo el mes de noviembre, el panorama resulta más claro: el tráfico a lo largo del mes es elevado, constante y cada vez más estable.

Alguna conclusiones destacables:

El Black Friday estuvo solo un 10,8 % por encima de la media diaria de noviembre.

El Día de Acción de Gracias fue flojo. Se observó un claro descenso en Acción de Gracias, lo que sugiere que los compradores estaban más ocupados con prioridades más tradicionales antes de lanzarse a las compras a la mañana siguiente.

El tráfico ha ido en aumento desde principios de octubre. Observamos una tendencia al alza constante hasta noviembre, otra señal de que la temporada alta comienza antes de lo que suponen la mayoría de los ciclos de planificación.

En general, noviembre ya no se comporta como un preludio de un único evento de gran volumen. Está empezando a parecerse a un periodo de demanda elevada.

Una mirada atrás: el Cyber 5 de 2024 y el de 2025

Para poder comparar el tráfico interanual de forma fiable, solo hemos evaluado a los clientes de comercio electrónico que enviaron tráfico a Fastly tanto en 2024 como en 2025.

A continuación, esto es lo que ha cambiado:

Lo que descubrimos es que los patrones de tráfico se mantuvieron prácticamente iguales, pero el volumen general aumentó, lo que sugiere que el comportamiento de los compradores no ha cambiado radicalmente. La diferencia más significativa es que, en 2024, los compradores se concentraban principalmente por la mañana, mientras que en 2025 el tráfico se mantuvo constante durante todo el día en Estados Unidos. Este dato concuerda con la estrategia de los retailers de escalonar las promociones y con las preferencias de los compradores a la hora de buscar productos: a través de aplicaciones, dispositivos móviles y redes sociales a cualquier hora del día.

Algunas de las diferencias que observamos pueden deberse simplemente a cómo se está dirigiendo el tráfico este año en comparación con el anterior, o a cómo los retailers deciden distribuir su tráfico, por ejemplo, utilizando una red de distribución de contenidos múltiple (Multi-CDN) u otras estrategias de enrutamiento que han evolucionado a lo largo de los años. Aun así, la tendencia general se mantiene: los compradores están repartiendo su actividad a lo largo de más horas y días, lo que contribuye a que la experiencia del Cyber 5 se perciba menos como un gran pico y más como un evento sostenido durante todo el día.

Este cambio se ejemplifica mejor al observar los datos durante un periodo aún más largo. Repitiendo la misma metodología de analizar solo los clientes de comercio electrónico con Fastly durante los últimos 5 años, tomamos el tráfico promedio durante el mismo periodo de cada año y lo comparamos entre sí.

Cuando observamos solo el año 2025, vemos que gran parte del mes se sitúa alrededor de 0, lo que representa el promedio diario del período. Si bien vemos que la mayor desviación de la media ocurre en el Black Friday, el pico posterior en el Cyber Monday está en línea con las desviaciones que vimos previamente en noviembre, reforzando la idea de que los compradores están llenando sus carritos a principios de mes.

La desviación en los patrones de compra previstos es más evidente cuando ampliamos esta visión a seis años, remontándonos hasta 2020. Desde esta perspectiva, podemos ver cuánto se desvió el tráfico de la media en 2020, 2022 y 2023 en el Cyber 5, mientras que 2025, por el contrario, se acerca más a la línea de desviación cero.

Esta perspectiva deja claro que los picos asociados al Black Friday y a todo el periodo del Cyber 5 ya no son lo que eran y las organizaciones deben planificar teniendo en cuenta estos datos.

Qué significa esto para los equipos de ingeniería y operaciones

La evolución de Cyber 5 no solo transforma el comportamiento de los compradores, sino que también transforma el enfoque de la fiabilidad. Estos patrones de tráfico resaltan dónde los equipos de ingeniería pueden necesitar ajustar sus estrategias para futuras temporadas.

La planificación para la temporada alta debe abarcar todo el mes, no solo cinco días. Dado que el tráfico aumenta antes y se mantiene elevado, noviembre se comporta cada vez más como un periodo prolongado de alta demanda. La planificación de la capacidad y la dotación de personal deben reflejar una carga continua, no un breve pico propio de las fechas.

Considera comenzar antes la fase de congelación del código de desarrollo. Si los compradores llegan antes, estabilizar los cambios antes reduce el riesgo. Las congelaciones vinculadas al comportamiento real del tráfico, y no a los plazos heredados del Cyber 5, ofrecen menos riesgo durante el aumento de la demanda.

La observabilidad en tiempo real es importante, pero el margen es más amplio. Los picos siguen produciéndose, pero se distribuyen a lo largo de más horas y días. Los equipos necesitan visibilidad en un intervalo de tiempo más amplio, con una supervisión ajustada para detectar la actividad sostenida en lugar de un único pico más acusado.

Estos cambios significan que la ingeniería en temporada alta ya no consiste en sobrevivir a un solo momento importante. Se trata de gestionar la incertidumbre, planificar el tráfico sostenido e incorporar la resiliencia en todas las capas para que los retailers puedan afrontar una temporada más tranquila.

Cómo ayuda Fastly a los retailer a gestionar las temporadas altas

Aunque el Black Friday sea ahora diferente, sigue habiendo mucho en juego en cuanto a rendimiento, seguridad y fiabilidad. La plataforma de Fastly está diseñada para ayudar a los equipos a adelantarse a ese cambio con herramientas que mejoran la estabilidad, la visibilidad, la resiliencia y la capacidad de respuesta durante los periodos de alta demanda.

Observabilidad para facilitar la toma de decisiones rápidas. A medida que el tráfico se distribuye cada vez más entre dispositivos, regiones y momentos del día, las herramientas de observabilidad de Fastly ayudan a los equipos a diagnosticar problemas de rendimiento de manera eficiente y a mantener una experiencia de usuario coherente.

Visibilidad en tiempo real para periodos de mayor tráfico. Con cargas elevadas que duran semanas en lugar de días, los equipos se benefician de una visión clara de los patrones de solicitud y rendimiento. Live Event Monitoring (LEM) proporciona visibilidad en tiempo real que ayuda a los retailers a identificar problemas con rapidez y mantener una experiencia fluida durante toda la temporada. Mediante Live Event Monitoring, los ingenieros de Fastly se coordinarán con tus equipos para lograr un objetivo común: ofrecer la mejor experiencia de uso posible sin que se note nada de lo que pasa entre bambalinas.

Una red diseñada para ofrecer un rendimiento constante. Las capacidades de enrutamiento y periféricas distribuidas a nivel mundial de Fastly ayudan a las marcas comerciales a ofrecer experiencias rápidas y fiables, incluso cuando la demanda fluctúa. Este aspecto resulta especialmente relevante a medida que los patrones de tráfico se extienden a más horas y regiones.

Actualizaciones instantáneas para promociones dinámicas. Los retailers ajustan con frecuencia los precios, el inventario y los activos creativos a lo largo del mes de noviembre. La función Instant Purge facilita estas actualizaciones casi al instante, lo que reduce el riesgo de que el contenido quede obsoleto durante los ciclos promocionales que cambian rápidamente.

Seguridad que protege los periodos clave de compras, y mucho más. Con un periodo más prolongado de tráfico elevado, los sitios de comercio electrónico se enfrentan a una mayor exposición. Las soluciones de seguridad de Fastly, como el WAF de última generación, Bot Management y DDoS Protection, ayudan a proteger las interacciones con los clientes y a mantener la estabilidad de los sitios web cuando la actividad alcanza su punto álgido.

En conjunto, estas capacidades ayudan a los retailers a afrontar una temporada alta que ya no se define por un único pico de actividad, sino por una demanda sostenida y un comportamiento de compra en constante evolución. Los datos de Fastly ponen de relieve algo muy evidente: la temporada navideña está evolucionando y el éxito depende ahora de la resiliencia y la visibilidad durante todo el periodo, no solo durante un momento concreto. Los retailers que reconozcan este cambio estarán en mejor posición para ofrecer las experiencias rápidas y seguras que los clientes esperan durante todo el año. Si te estás replanteando cómo prepararte para la próxima temporada alta, estaremos encantados de ayudarte a diseñar una estrategia que te proporcione estabilidad, visibilidad y rendimiento durante todo el año.